In an exclusive interview with the Iraq International News Agency, Taha Ahmed Abed Al Salam, the Executive Director of the Iraq Stock Exchange Market said:

The Iraq Stock Exchange was established in 2004 based on the law number 74, in addition to the Securities Commission as the regulatory and supervisory body, as well as the association of Money Market Brokers in Iraq. This exchange aims to implement a set of objectives related to the shares of joint stock companies and the used financial instruments issued in Iraq.

On this basis, since 2004, the market began to organise trading sessions, by which we mean the times of buying and selling operations and cooperation by shareholders and investors.

The shareholders are the ones who own the shares of Iraqi joint stock companies, which are 103 joint stock companies representing various economic sectors.

Almost every company has a capital of more than 250 billion dinars, corresponding to 250 billion shares per bank. There are two telecommunications companies, there are private and mixed industrial companies as well as tourism and hotel companies which are also private and mixed. In addition, there are agricultural companies, insurance companies and financial investment companies. This is on the part of shareholders who wish to buy and sell shares listed in the market.

By which we mean that the shareholders’ records be acceptable and within the technical specifications of the central depository system

This system depends on the acceptance of the register of shareholders, which shows the details who own the shares of the capital, which must be identical to the size of the total capital, which means that the market uses a global electronic system provided by NASDAQ company. Like the Arab countries and some European countries, it relies on a database based on and received from the shareholders’ registers, and on the basis of it, all movements related to the trading of company shares are made in the daily trading sessions and the capital increase is done automatically through the Depository centre. Potential shareholders and investors are the people who make purchases for the first time or for several times in order to be shareholders in joint stock companies

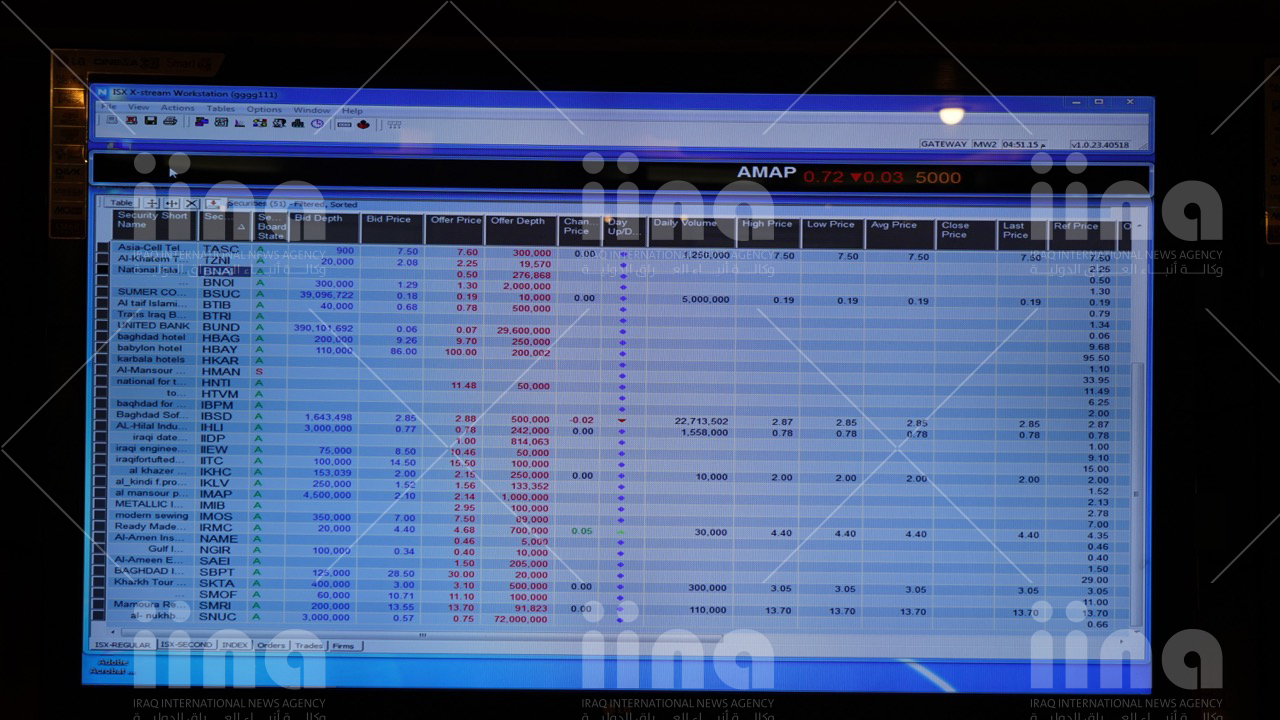

There are 103 listed companies whose shares are traded daily from Sunday to Thursday.

Trading timings extend from 9:30 AM until 1:30 PM. The introductory period is from 9:30 AM to 10:00 AM, which is the exploratory session for entering all buy and sell orders in order to extrapolate the prices that will be executed automatically at 10:00 AM by the electronic trading system

The trading session starts from 10 AM until 1 PM which enables shareholders and investors to trade according to the influences of supply and demand and according to the information published by the joint stock companies which are published on the day of the trading session

Then from 1 PM until 1:30 PM, the process of large transactions begin which depends on special disclosure processes, special banking care controls, and care controls for securities dealers and knowledge of information related to know your customer.

These processes end at 1:30 PM. In which the final closing takes place and the market index is issued, the index of traded stock prices which we call it ISX 60 being based on indices, trading weights, share prices and the market value of 60 companies that are characterised by being continuous in trading and the absence of suspensions on them, and that the annual disclosure be received accurately and in its official timings.

From 1:30 PM till 2:00 PM, financial and stock settlement processes begin, whoever sells the shares receives the price of his shares through the clearing bank or from the Iraqi banks that he deals with whoever buys the shares has to pay on the same day of the session.

On the same day, the money is transferred from the buyer to the seller.

All of these processes are done through the brokerage companies.

Brokerage companies depend on back office system which manages the trading and accounting process and it is related to the electronic trading system which is named Extreme and it is provided by Nasdaq for dealing in global stocks and bonds

This is a summary of the processes that take place between depositing the register of shareholders,

depositing investor certificates if found, and then the opening of the accounts for the shareholders and the investors.

Then the trading processes take place based on the electronic trading system used since 2009.

Then moving in to the financial and stock settlement processes. This is related to posting reports and disclosures which starts from 2:00 PM the relevant departments carry out trading audits according to implemented mechanisms as well as posting of the daily reports based on trading indicators and the information for the receiving companies on the same day or on any other day.

The Iraq Stock Exchange Market has affiliations to federations, including the Arab Federation of Stock Exchanges and the European and Asian Financial Markets Union and it is a part of the database of the Arab Monetary Fund and the database of the Mubasher Agency. The purpose of this is to broadcast the information and the prices of the shares exchanged.

The financial and informational disclosure instantly on the same day of the trading session and sometimes on the same session for the concerned company when there are substantial decisions and events. In general, we should inform the shareholder or investor of any information related to or affecting the prices of traded shares, as well as the operations or volume of supply and demand.

- Published: 27th March 2023

- City: Baghdad

- Country: Iraq

- Category: Interviews