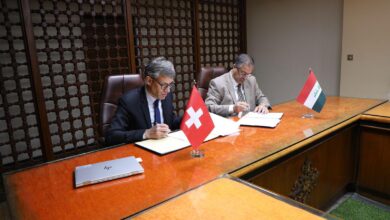

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, has reaffirmed the country’s commitment to digital transformation in the financial sector during the inauguration of the 9th Finance and Banking Services Exhibition and Conference. The event brought together key banks and payment companies operating in Iraq, showing the nation’s progress in electronic payments and financial inclusion.

In his speech, Governor Al-Alaq emphasised the rapid development of Iraq’s electronic payment system, citing a significant increase in the number of ATMs and credit wallets. He noted that the Central Bank’s support has helped double the financial inclusion rate in Iraq, rising from 20% to 40% within two years.

Al-Alaq also addressed the technological evolution within Iraqi banks, particularly in currency transfers and digital transactions, as they adopt globally recognised financial systems. These advancements are expected to streamline banking operations and make financial services more efficient.

He further highlighted a global trend towards digital payments, forecasting the gradual decline of paper currency. He revealed that the Central Bank of Iraq is exploring the creation of its own digital currency, aligning with international developments in central bank digital currencies (CBDCs).

As Iraq takes decisive steps towards financial modernisation, the Governor called for a comprehensive national strategy for digital transformation, ensuring that Iraq remains competitive in the evolving global economy.

Source: CBI

- Published: 3rd March, 2025

- Location: Baghdad

- Country: Iraq

- Editor: Yasmine Goumri

- Category: Economy